Our Methodology in Comprehensive Planning

Conducting a review or analysis on one’s finances can be tough, since it requires an organised collection and evaluation of financial information. We also understand that every client has their unique financial situations.

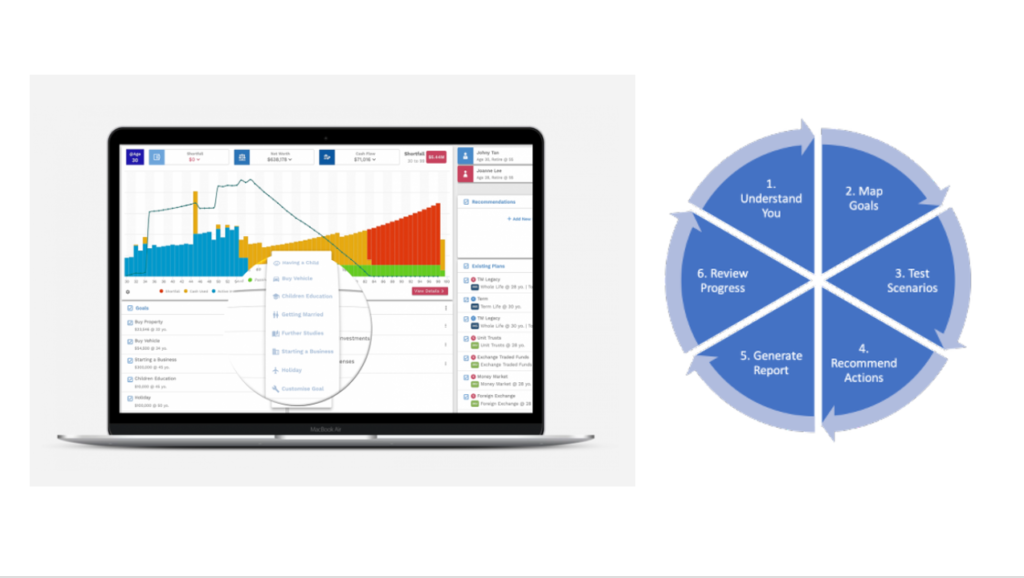

Therefore, during the consultation session, we will run through your exact situation in which you are currently in, allowing you to have a precise picture of your current financial status. We will professionally identify the gaps in your financial health, analyse if your existing financial position is robust for life changes and emergencies, and help you to visualise potential real-life scenarios and how our proposed solutions can help you achieve your goals and dreams in a shorter possible time. We explore a broad spectrum of concepts and strategies, and cover extensive areas on the topic of finance.

Our clients will get a concise financial report, indicating the 6-steps analysis, to better plan for their future.

There are so many unforeseen circumstances in life that can happen anytime anywhere and we believe no one insurance or investment per say can exhaustively cover these areas. Thus, we created a list of services that aims to comprehensively cover the concerns and areas where you may or may not even be aware of, unlocking a whole new idea and experience of what we call, comprehensive financial planning.

Our Methodology in Wealth Planning

With increasing standard of living and changing dynamics in the finance world, people are learning or finding ways to build wealth, and best of all, hoping to make money while asleep. Therefore, the word “Investment” is a hot topic.

So what exactly is Investing? It is basically setting aside money while we are busy with life and have that money work harder for you so that you can fully reap the rewards of our labour in the future. In other words, investing is a means to achieve a potential happier ending. And there are various kinds of investment vehicles out there – putting money into stocks, bonds, mutual funds, real estates, reits, forex, cyrptocurrency, ETFs, so on and so forth.

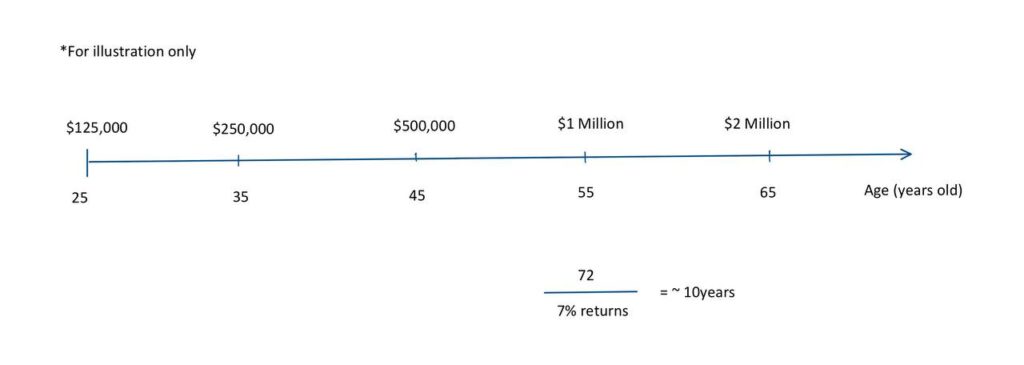

But today we will not be talking about the type of vehicles, but more of the strategy in achieving our financial goals. One of the strategies Xlitude use to help our clients achieve their goal will be via Rule of 72. It’s a simplified way to determine how long an investment will take to double, given a fixed annual rate of interest.

Firstly, let’s assume that one wants a comfortable retirement from age 65 and would like to have $2 million to live up to 85 after factoring inflation. That said, should the investment vehicle be able to bring you *7% returns annually, it will require you to have S$1million at age 55 to invest (72÷7 ≈ 10 years). In other words, it takes 10 years for your investment amount to double when your annual rate of return is *7%. As you work this backwards, you will need S$500,000 at 45 years old, S$250,000 at 35 years old or S$125,000 at 25 years old, to reach S$2million by 65.

Hence, with this strategy, it doesn’t matter which investment vehicle you use but how confident you are in achieving the rate of return to reach your goal. And the higher your rate of return, the lesser amount you need to set aside to reach retirement or retire earlier with the same amount put in; vice versa.

Now, the question is, how do I achieve *7% returns annually and consistently to reach my goal? Can I achieve even higher returns and how do I go about starting such a portfolio? If you would like to find out how exactly rule of 72 can help in achieving your dream and to have a financial blueprint craft out personally for yourself, speak to your existing Financial Adviser Representatives from Xlitude group or drop us a message if you would like to find out more!

* 7% is for illustration purposes